In 1990-91, the area under coffee in Kerala was 84016 hectares accounting for 31.06% of 27,0513 hectares with a production of 21,884 tons of coffee and a share of 12.89% of 1,69,726 tons in India. After two decades, during 2011-12, the area declined marginally to 84000 hectares but its percentage share significantly declined to 20.53%, whereas the production and its share significantly increased to 6800 tons and 21.65% of that in India respectively. Thus, a yield which was very low at 260.47 Kg/ha in 1990-91 as compared to 627.42 Kg/ha of national average increased substantially to 809.52 Kg/ha as compared to the national average of 763.73 Kg/ha in 2011-12. However, the productivity of the crop in terms of bearing area in Kerala (705 kg/ha) is lower than the national level of 826 kg/ha.

Varieties of Coffee grown in India

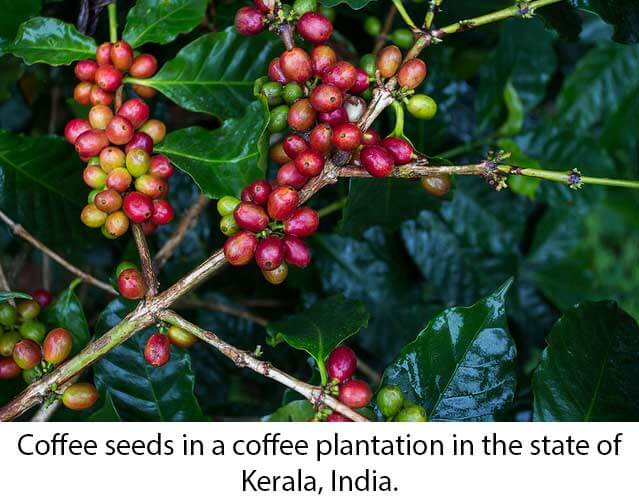

Coffee has been grown in India from the early 17th century, though there is no consensus on how the cultivation began. There are currently many versions of how coffee came to be cultivated in India. Robusta variety shares 95% of the planted area in Kerala. Kerala accounts for 20.70% of the total coffee area in the country whereas Robusta and Arabica share 28.59% and 2.10% respectively in the country. For FY2014-15, estimates of the total production of coffee in Kerala stands at 67,700 tons, comprising Arabica [2055 tons] and Robusta [65,465 tons]. Kerala accounts for 96.70% of Robusta coffee production and a 3.30% share of Arabica coffee as compared to 70.03% of Robusta and 29.97% of Arabica production at the national level. Robusta fetches lower prices in the domestic and international markets than Arabica. The brewing value of Robusta is also comparatively low. Though irrigation can increase the yield of Robusta by 60% to 70% small coffee growers do not provide irrigation due to the high costs of sprinkler and drip irrigation systems. The average lifespan of Robusta coffee plants varies from 60-80 years and requires the least amount of pesticides. Planters in Kerala prefer a multi-cropping pattern consisting of coffee, tea, and spices to optimally utilize resources and insulate the plantation from vagaries of nature and market. A special feature of the coffee plantation in Kerala is that the coffee plants are grown under the shade of tall shady trees. Monsooned coffee is a special delicacy of the Malabar region. A less known fact about this Malabar coffee is that it was discovered by accident. About 90% of holdings in the Wayanad coffee region are below 2 hectares in size. These holdings are mainly owner-operated and casual wage labor is sparingly engaged. Though coffee is a labor-intensive plantation only large estate owners employ permanent and casual workers. Small and marginal farmers practice mixed farming; they shift crops according to the changes in market conditions. Particularly, when coffee prices fall, they reduce working expenses on coffee and shift to other crops especially to pepper. Pepper vine and areca nuts are quite common in coffee gardens of small farmers. Since 1976, the Kerala Forest Development Corporation has been managing all coffee estates including territories in Pamba, Kallumala, and Cheeyambam in Wayanad district. Areas not suitable for cardamom cultivation have been exclusively planted with coffee. Robusta fetches lower prices in the domestic and international markets than Arabica. The brewing value of Robusta is also comparatively low. Though irrigation can increase the yield of Robusta 60% to 70% of small coffee growers do not provide irrigation due to the high costs of sprinkler or drip irrigation system. The average lifespan of Robusta coffee plants is 60-80 years and requires the least amount of pesticides.

Wayanad region has more than 33% of the district’s area under coffee, called a green paradise and coffee county of Kerala with high hilly areas and places of tourist attraction. Coffee is grown in Wayanad as a single crop as well as with pepper. There is a very small 10-acre farm at Coffee Aroma resort which is merely an added attraction to this tourist place away on the slopes of the Chembra Peak. Conducive climate, seething hills, and greenery make Malabar region wonderful so are flora and fauna that enhance its attraction. With the economic liberalization in 1991 in India, the role of the Coffee Board has been diluted considerably and the pooling system was abrogated. In 1993 the Internal Sales Quota [ISQ] entitled coffee growers to sell 30% of their products in the country. Subsequently, the amended Free Sales Quota [FSQ] in 1994 (FSQ) permitted large and small scale growers to sell between 70% and 100% of their coffee either domestically or internationally. And finally, an amendment in 1996 fully liberated all coffee growers and allowed them the freedom to sell their produce wherever they wished. However, this led to the emergence of intermediaries in trade, and in absence of regulated and development agency to coordinate and provide directions to coffee marketing, the middlemen collect coffee directly from farmers at a reduced price and sell to wholesalers/exporters at a high price. Farmers often sell coffee well in advance of the harvesting season at prices much lower than those prevailing in the market in order to tide over their financial difficulties. After the withdrawal of the Coffee Board, the vacuum created for some time has been to an extent replaced by private sector initiatives like Indian Coffee Trade Association (ICTA), which began auctioning on a periodic basis. There are also efforts towards online trading which is being conducted through web portals. However, the overall scenario is that less than 10% of coffee is sold through auctions as most small growers prefer to sell the unprocessed crop directly to exporters or roasters through agents As coffee consumers in Kerala are increasing the demand for domestic consumption is expected to rise. While international coffee chains are already planning their strategic entry in Kerala, domestic coffee chains are also expanding their businesses to capitalize the market opportunities. The latest entrants include Hilite Group of Kozhikode, Beans, and Flavours, a small coffee blender from Idukki district and Tonico. Hilite Group plans to establish a chain of 100 coffee shops on the NH47 and NH 17 shortly. The domestic coffee chains have the potential to succeed and produce some global brands on account of factors like ambiance, product quality, and services. In the Coffee value chain, farmers capture not more than 20 % of the end value. Other Intermediaries and traders (local and international) and roasters gain substantially. It is estimated that roasters alone retain about 30% of the value, and brands also play an important role in the value chain. Given that it is a buyers’ market, there are always efforts to reduce the value for the primary producers. Mechanisms like certification are aimed at allowing fair margins at the producer level but often they become counterproductive due to a host of reasons. Government has initiated some measures to help farmers mitigate distress that include, among others,

Need for Focused Attention

There is an immediate need to conduct Action Research Project to study comprehensively and understand the following facts and suggest changes in policy and programs in consultation and dialogue with farmers For enhancing coffee productivity and quality, streamlining marketing and financial viability of small farms focused attention is urgently required in the following areas.

Product diversification, quality improvement, mechanization of specific farm operations, professional management and technical inputs, post-harvest processing, supplementary income-earning opportunities to enable small growers to remain in production chain with cost competitiveness. Enhancing domestic consumption to help in price stability Labour and social security reforms to enhance productivity and cost competitiveness To crystalize in unambiguous terms the role of the Government, International Coffee Organization, Coffee Board, trade exchanges, and traders to ensure reasonable returns to small growers and their effective participation in the markets. Vertical integration of small producers on lines of AMUL Dairy & Gujarat Milk Marketing Federation in Gujarat to enhance value for the primary producers Optimum utilization of services currently offered by the Coffee Board viz. research, extension, development, quality up-gradation, economic & market intelligence, internal & external promotion of coffee marketing and labor welfare to create visible impact on coffee farmers’ economy Efficient use of subsidy schemes for re-plantation, water augmentation, quality up-gradation, and farm mechanization should motivate/encourage growers to replant coffee with Arabica variety, provide irrigation to Robusta coffee, reduce labor cost and improve productivity and quality of coffee Price discovery is primarily through comparison with respect to International markets and planters are expected to be aware of such information through media and ICT related interventions like online trading platforms. However, farmers’ participation in auctions (online) and futures trade as planters is extremely low. While at one level planters are not adequately exposed to price movements through forwarding sale contracts, they feel that farm gate sales would provide them with spot price. This necessitates creating awareness among farmers about the pros and cons of futures markets that should help small growers to make informed decisions that can benefit them.